October Newsletter

The ‘H’ Word

This month Twitter CEO Jack Dorsey dropped the ‘H’ word: Hyperinflation.

Hyperinflation is going to change everything. It’s happening.

— jack⚡️ (@jack) October 23, 2021

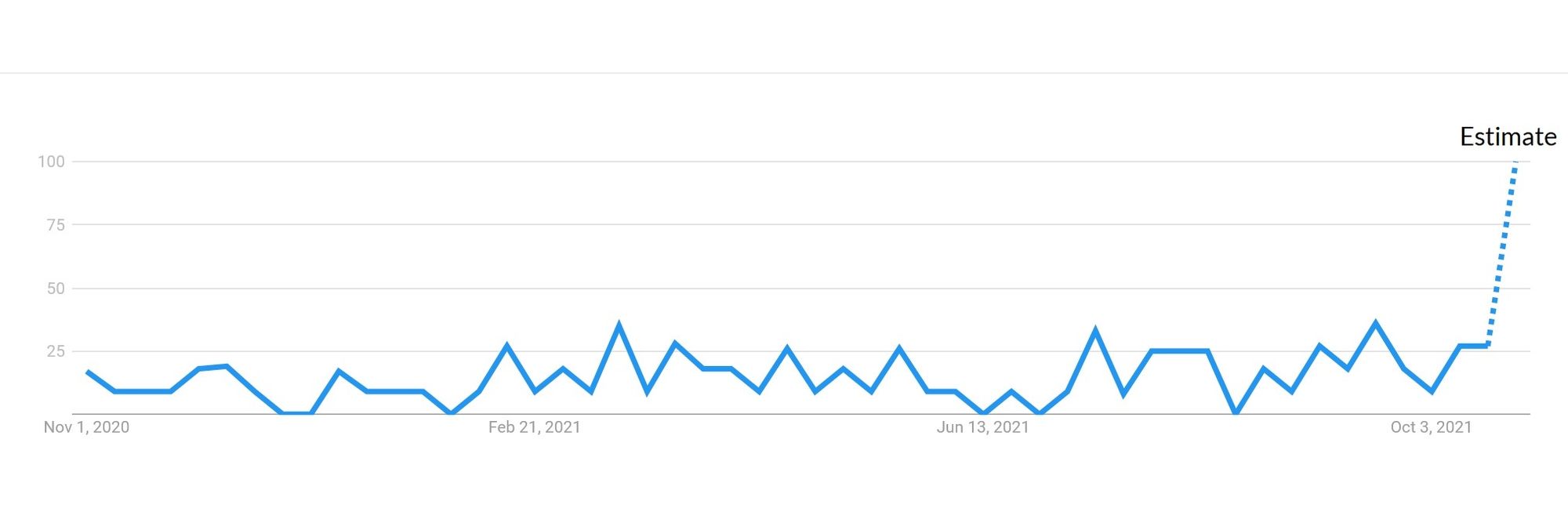

Wikipedia defines hyperinflation as “very high and accelerating inflation” and Google trends data indicates that searches by Australians for the term Hyperinflation have sky-rocketed. Is this something we should really worry about?

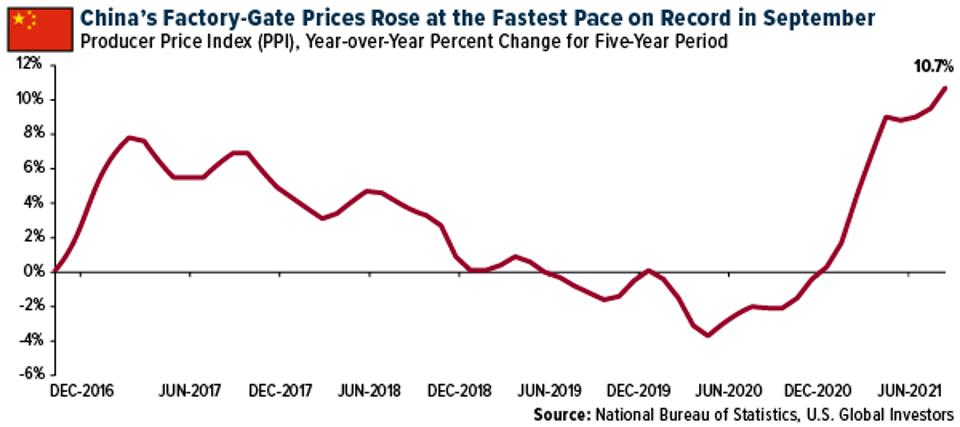

The Reserve Bank of Australia recently released the CPI (Consumer Price Index) data for the September quarter. On an annual basis, CPI in Australia rose by 3%. This is high on a historical basis, but certainly not hyper-inflationary. However, CPI only tells us what happened in the past. Another indicator tells us what will happen in the future: The Producer Price Index (PPI). This index shows how costs are changing for manufacturers, and therefore predicts future consumer prices. The chart below shows the PPI in China, which has increased by nearly 11% annually. This means we should expect to see a commensurate increase in the prices of Chinese made goods in the near future. With crude oil also at the highest price since 2014, which negatively impacts the cost of transport and food, it seems likely that we will see a much higher CPI figure released in the next quarter.

Bitcoin ETF Update

A major milestone was achieved for bitcoin this month, with a bitcoin ETF being approved in the USA. The ProShares ETF started trading on 19 October and fell just shy of US$1 Billion of assets-under-management on its first day, making it one of the most successful ETF launches of all time. Already, two more ETFs, from Valkyrie and VanEck, have been approved for trading. Here in Australia, CEO of BetaShares, which manages many large ETFs listed on the ASX, believes a bitcoin ETF in Australia is ‘inevitable’.

Bitcoin Mining in Australia

Byron Bay now hosts a renewable-powered bitcoin mining operation. The site is a partnership between Sydney based Mawson Infrastructure Group and renewable energy specialists Quinbrook Infrastructure Partners. The 20 Mega-Watt facility will add 0.4 EH (ExaHash) of mining power to the bitcoin network, which currently generates around 150EH globally. The facility has the ability to curtail operations during periods of peak power demand, allowing power to be sent to retail consumers when it is most needed. Due to the ASX prohibiting crypto-currency focused firms from listing, Mawson is listed on the NASDAQ stock exchange in the USA.

Price Analysis – New All Time High

October was an exciting month for those closely watching the bitcoin price, with new highs being set in both the Australian and US dollar. Bitcoin briefly broke through AU$90,000 in the middle of the month before consolidating closer to AU$80,000. In USD terms, bitcoin traded just shy of US$67,000, eclipsing the previous high of US$64,898. The new price-records coincided with the launch of the US based bitcoin ETF with the associated press coverage no doubt generating some positive sentiment. While the price action has been more subdued towards the end of this month, importantly it has all occurred above a new support level. This may well form the base from which bitcoin will make its next move to significantly higher prices.

On a Lighter Note

In the future, we will speak in Satoshis (or Sats; 1 Satoshi = 0.00000001 bitcoin); in the meantime, keep your calculator handy.