Are house prices trying to tell us something?

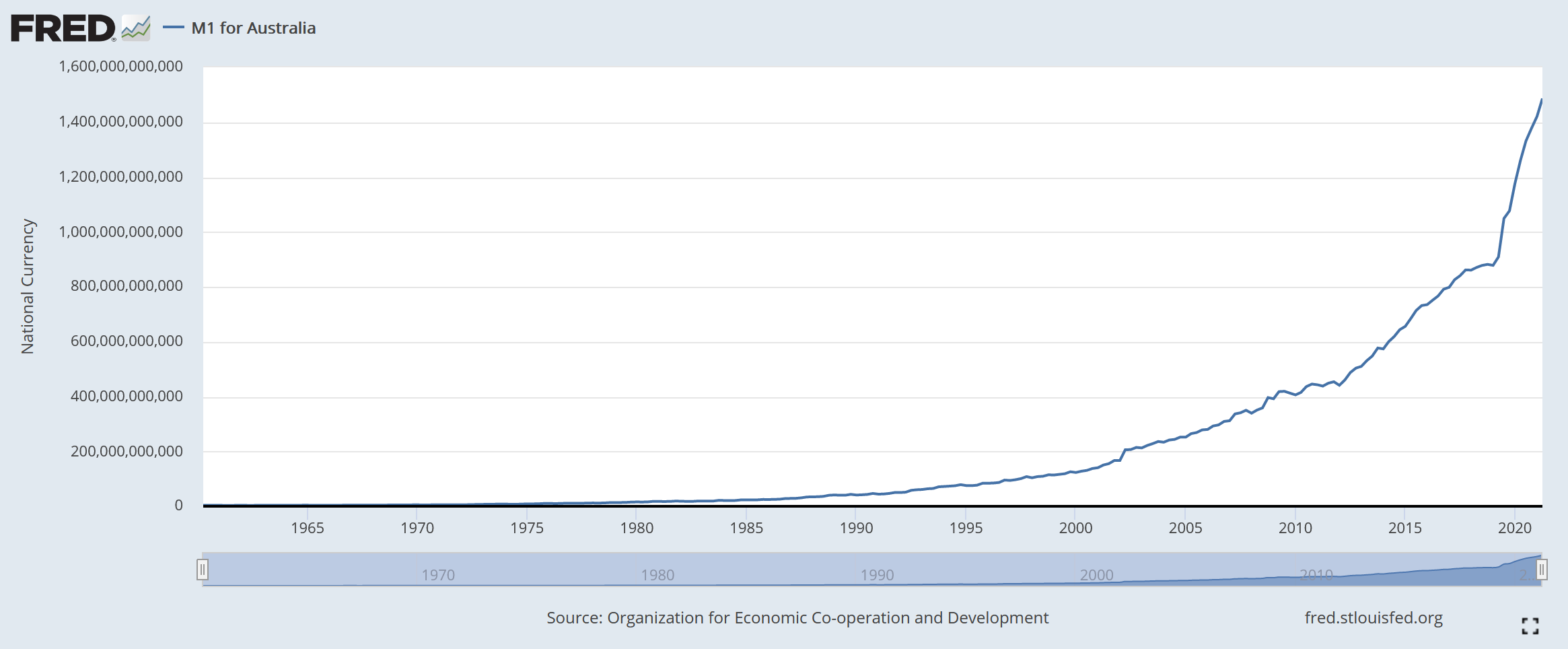

You may have noticed that houses are getting a little more expensive in Australia. Median house prices in Sydney rose 24%. To give that more context, in Sydney the price of a median house increased by $273,000. In one year. Across Australia, house prices have increased by 16.1%. So, where is all this money coming from? Well, it so happens that the supply of Australian dollars (known as M1) increased by 16.6% in the 12 months to June, which is a suspiciously familiar number. If you flip the equation around, you can see that house prices are not increasing, but the value of our dollars is decreasing, which anyone trying to save a house deposit can resonate with. While hyperinflation might sound like one those of things that only happens in history books, the signs are pointing in a scary direction right now. And Australia is not alone, this article looks in depth at the risks in the US. This is why at HardBlock advocate for saving with Bitcoin, which has a capped supply that no government can increase.

Free Webinar – Understanding Bitcoin

Here at HardBlock our goal is to help our customers through the entire process of saving with bitcoin. We recognise that Bitcoin is complicated and a different way of storing your wealth than you might be used to. With that in mind, we have developed a free webinar to walk new users through the concepts, from learning why we need bitcoin (hint: see graph above) to how the Bitcoin protocol works and the best ways to store bitcoin. There will also be an opportunity to ask questions. Sign up to the webinar here.

Are Bitcoin ETFs coming?

Exchange traded funds allow investors to purchase shares on a stock exchange which give them exposure to underlying assets such as a basket of companies, real estate, commodities or potentially bitcoin. A bitcoin ETF already exists in Canada, but so far none have been approved for the US market. However, the head of the Securities and Exchanges Commission suggested that applications for bitcoin ETFs based on bitcoin futures may get approved. Futures are a type of contract used mostly in the mining and farming industries to hedge prices. While not the same as directly owning bitcoin, a futures based bitcoin ETF would make it significantly easier for many investors to gain exposure to bitcoin, which can only be good for the price.

Price Analysis

Having briefly flirted with the AU$40,000 level on 20th of July, things have turned much more positive for bitcoin, with the price touching AU$70,000 around a month later (a 75% gain) before calming down somewhat over the last week. Given we are back to a more positive trajectory, this raises the question of where we might be going. Plan B, creator of the Stock-to-Flow model is projecting a price of US$100,000 (~AU$137,000) per BTC by the end of 2022, roughly double the current price. While the future is uncertain, it seems highly likely that we’ll see a new all-time high price this year.

The Bitcoin Whitepaper

Have you read the Bitcoin whitepaper? Nine pages that will change the world.