SatsSpend (Australian Bitcoin Business List) Gets a Make-over

Wondering where to spend your bitcoin? Check out SatsSpend - the Australian Bitcoin Business List!

SatsSpend is a community project sponsored by HardBlock. SatsSpend's aim is to maintain a list of Australian businesses that accept bitcoin payments, as well as to provide links to helpful resources for both spenders and recipients of bitcoin. SatsSpend was previously a simple text list on a Github page, but it's just had a make-over to include a search feature and an interactive map.

Let us know if there are any other Australian businesses which accept bitcoin that we can add to the list!

Bitcoin Headlines

Feeling time-poor and want to listen to the latest bitcoin news? Check out the Australian Bitcoin Podcast's recent news episodes for a summary of the stories below (Episode 28 and Episode 31).

Global News

- Consumer Price Index (CPI) continues to rise across the globe; eg, Australia's annual CPI (as of the quarter ending in July) is 6.1%; New Zealand's annual CPI (as of June) is 7.3%, Eurozone 8.6%, United States 9.1%, United Kingdom 9.4%, Spain 10.2%, and Turkey 78.6% (no, that's not a typo!)

- Sri Lankan Prime Minister declares nation ‘bankrupt’; consequently, Sri Lanka President flees the country as social unrest and calls for his resignation escalate

- Bank of Japan now owns more than 50% of all Japanese bonds after starting "temporary" quantitative easing in 2001

- Gary Gensler (Head of the SEC) labels bitcoin a ‘commodity’ again, while alluding to other cryptocurrencies as likely non-complying securities

- SEC rejects Grayscale spot bitcoin ETF application (again!), so Grayscale sues the SEC for its arbitrary and capricious stance on bitcoin spot ETFs

- Bitcoin Policy Institute submits report to US Department of Commerce on Digital Asset Competitiveness to explain what bitcoin is, why bitcoin is the important digital asset and not other cryptocurrencies, and the numerous positive humanitarian and environmental impacts of bitcoin

- Vladimir Putin signs law banning bitcoin as a means of payment in Russia, although citizens can still buy and sell bitcoin as an investment

- Paraguay’s cryptocurrency framework is at the final stage of approval - the proposed laws place greater reporting requirements and additional costs on bitcoin miners, while making life a little easier and clearer for other bitcoin businesses (eg, exchanges)

- Andorra (a European country between France and Spain) green lights a proposed Digital Assets Act which enables the country to issue their own cryptocurrency, while also providing regulatory clarity and incentives to bitcoin businesses

- Central African Republic is launching its own cryptocurrency (called Sango coin), but they are also planning to hold bitcoin as a reserve asset of the country

- Tesla sells 75% of its bitcoin (~US$930 million); Elon clarified the sale was due to Tesla needing to urgently add cash to its balance sheet and that he is not against buying bitcoin again in future

- 3 Arrows Capital (a cryptocurrency investment and hedge fund) declares bankruptcy, owing debtors throughout the industry close to US$4 billion; 3AC founders Su Zhu and Kyle Davis were later detained at an airport in Dubai while trying to board a private jet to Switzerland

- FTX (cryptocurrency trading platform) attempts to bail out the insolvent loan- and yield-providing service BlockFi with a US$400 million credit facility

- Morgan Creek Digital counters FTX’s BlockFi bailout attempt, because if FTX’s bailout is successful, it will wipe out all BlockFi shareholders including Morgan Creek

- Voyager (cryptocurrency yield-providing and lending platform) files for bankruptcy weeks after receiving a line of credit from FTX worth around US$485 million

- Goldman Sachs (leading American investment and banking group) coordinates US$2 billion of lending for purchases of yield-providing platform Celsius' assets when Celsius declares bankruptcy

- Celsius initiates bankruptcy proceedings; they owe users over US$4.7 billion

- India-based cryptocurrency exchange (Vauld) freezes withdrawals due to insolvency; Vauld has over a million customers with more than $1 billion under management

- Citibank (global bank managing US$27 trillion for over 200 million customers in 160 countries) hires Swiss firm Metaco to establish a digital asset custody platform

- OpenNode partners with Lemon Cash (a Latin American fintech company) to bring the Lightning Network to over 1 million Argentines

- NYDIG announces alliance with Deloitte to provide global bitcoin banking for all

- New York Yankees partner with NYDIG to pay staff and players in bitcoin

- The US and Britain decide to ban gold imports from Russia

- India has raised its import tax on gold to 12.5% from 7.5%, in an attempt to dampen demand for the precious metal and to strengthen their fiat currency

- Zimbabwe introduces gold coins as an inflation hedge as their local currency collapses

Australian News

- RBA raises interest rates to 1.35% and intends to continue rate increases to curb inflation: they claim inflation will peak later 2022 and then return to 2-3% in 2023

- BTC.com.au (an Australian cryptocurrency trading platform since 2018) is closing down due to recent cryptocurrency and stock market liquidation events

- Volt, Australia's first online-only bank, shuts down due to issues raising new funding

- Digital-X (a digital assets fund), an ASX listed company, holds ~216 bitcoin on their balance sheet - not new news, but noteworthy none-the-less! It also turns out their CEO converts 5% of her salary into bitcoin

Technical News

- Samsung announces new 3nm chip to be used in next generation bitcoin miners to increase hash rate and decrease energy use (with a reported 30% efficiency boost)

- Level39 (Bitcoin Magazine contributor) releases comprehensive thread on how bitcoin mining helps to stabilise energy grids, particularly as the world moves towards adopting more intermittent renewable energy sources

- Bitcoin Optech Newsletter (Issue #207) summarises recent discussions about long-term bitcoin block reward funding (including the unlikely potential of increasing bitcoin's supply); the discussion regarding pros and cons of changing bitcoin's supply is continued in Bitcoin Optech Issue #209

- Bitcoin Lightning Network reaches a new all-time-high capacity of ~4,300 BTC

- Cryptocurrency "Fear and Greed" Index recently spent its longest period ever (over 72 days!) in the "Extreme Fear" category

Price Analysis – Bitcoin and Bonds and Commodities, Oh My!

They say a picture is worth a thousand words, but a video is so much more. Check out this recent episode from the Australian Bitcoin Podcast to hear Jeremy's bitcoin technical analysis and a summary of other current macroeconomic happenings.

We apologise for the low audio volume - that'll be fixed in future episodes!

Food For Thought – Mental Gymnastics Can't Outrun The Cantillon Effect

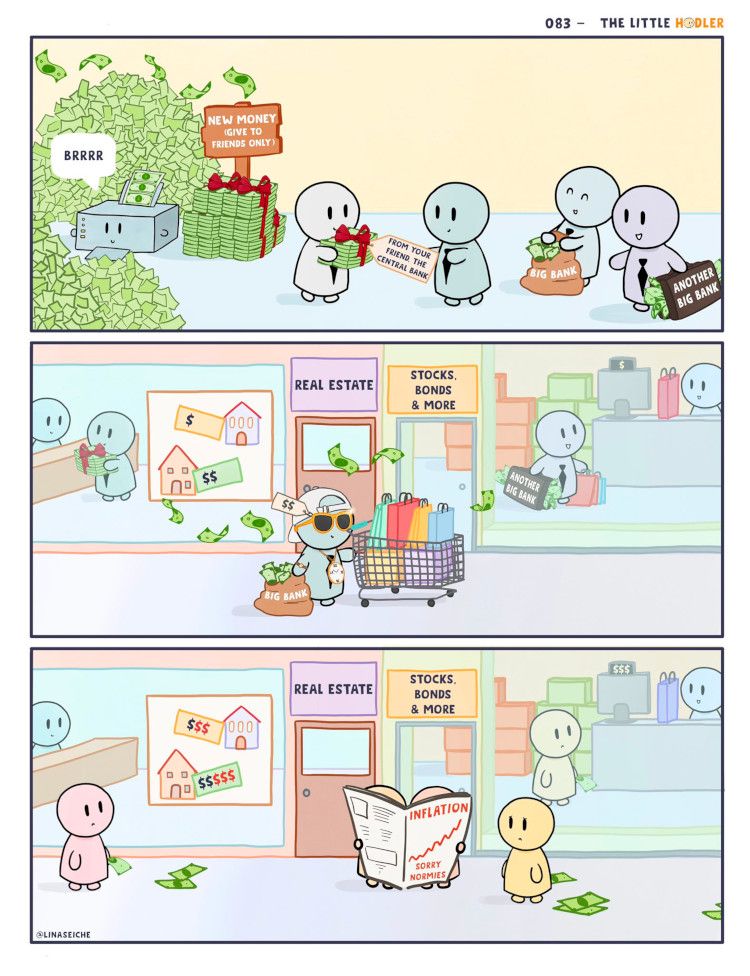

While central bankers and fiat economists perform unrelenting mental gymnastics in an attempt to convince the world that expanding the money supply doesn't lead to price inflation, the rest of us bear daily witness to The Cantillon Effect.

The Cantillon Effect, coined by economist Richard Cantillon in his 1755 seminal work Essai sur la Nature du Commerce en General, describes the inevitability of how creating more money without an equivalent value creation will cause there to be more dollars chasing the same amount of goods, which pushes the cost of those goods higher (ie, because demand increases while supply stays the same).

Cantillon further describes how the beneficiaries of monetary expansion tend to be those closest to the proverbial "money printer"; namely: governments, central banks, private banks, and any large organisations they're partnered with. In sum, the top 1% (or even 0.1%!) get richer, while the rest have their life savings and daily purchasing power eroded.

Luckily, on a long enough time scale, bitcoin fixes this!

HardBlock Careers – Expression of Interest

Interested in joining the HardBlock team? We occasionally recruit for bitcoiners with a range of skills and experiences. Submit an expression of interest if you're keen!