Bitcoin Headlines

Feeling time-poor and want to listen to the latest bitcoin news? We hear you! Check out the Australian Bitcoin Podcast's recent news episodes for a summary of the stories below (Episode 22 and Episode 24).

Global News

- United States annual Consumer Price Index (CPI) rose to 8.6% in May, a 40-year high (with shelter, food, and gas being the biggest contributors)

- Janet Yellen (US Treasury Secretary) admits she was ‘wrong’ about ‘path inflation would take’ when previously claiming it wouldn't happen or would only be transitory

- To fight sky-high inflation, the Federal Reserve (the US central bank) raised interest rates a whopping 0.75% to a new level of 1.5%

- Eurozone annual CPI hits 8.1%, highest level ever and significantly above previously-announced targets

- Turkey's annual CPI soars to 73.5% in May, highest since 1998

- Cynthia Lummis (US Senator) has officially introduced her bitcoin and crypto bill that includes recognising bitcoin as a commodity, tax exemptions for low value transactions, as well as clearer rights for citizens to control the bitcoin they own

- New York passes a proof-of-work mining ban which will limit new bitcoin miners joining the industry in New York for the next two years; although Governor of New York still undecided if they will agree to the ban

- Joe Biden (US President) administration renewing efforts in their consideration of bitcoin mining regulation

- Alex Gladstein (Chief Strategy Officer of the Human Rights Foundation) and human rights advocates from 20 countries across the globe have sent a letter to US Congress to detail the positive humanitarian impacts of bitcoin

- Russia’s Ministry of Finance is ‘actively considering’ the use of digital currencies for international payments, a government official reportedly said (again!)

- Gazprom (third-largest oil producer in Russia) is partnering with BitRiver (a bitcoin mining company) to mine bitcoin with its excess oil resources

- Russia blames US inflation on their 38% currency creation in past two years, and EU inflation and energy crisis on their unreliable energy policies

- Kenya’s largest producer of electricity intends to deliver excess geothermal energy to bitcoin miners

- Bank of Canada (ie, the Canadian central bank) reported that the number of Canadians holding bitcoin doubled from 2020 to 2021

- Fidelity (US$4.5 trillion asset manager) to double headcount for their bitcoin and digital assets division

- Goldman Sachs is reportedly looking to integrate services with bitcoin and crypto exchange FTX

- Majid Al Futtaim Group (a retail giant) will soon accept bitcoin payments in 29 of their shopping malls and 13 hotels in Dubai; this group also operates over 400 supermarkets and 600 cinemas which may eventually also accept bitcoin payments

- Octagon Networks (an American cybersecurity firm) has converted its entire balance sheet into bitcoin after being inspired to do so by Michael Saylor of MicroStrategy

- Top 30 bank in Panama (Towerbank) has declared it is bitcoin friendly

- Block releases a "Bitcoin [Global] Knowledge and Perceptions" survey report

Australian News

- Australian annual CPI expected to reach 6.7% during June measurements

- Reserve Bank of Australia has raised interest rates for the second month in a row, increasing by 50 basis points to 0.85% in an attempt to curb rising inflation

- Australians 'panicking' as power prices skyrocket, consumer advocates say; with high energy prices unlikely to end soon

- Australian economists indicate that the downturn affecting traditional Australian superannuation funds (eg, equities and bonds) may be much worse than expected

Technical News

- Lightning Network capacity reaches an all-time-high of 4000 BTC

- Bitcoin hash rate reached a new all-time-high of around ~241 exahash per second (according to Braiins Mining Insights)

- 2022 Lightning Network Summit was held in Oakland, California to discuss a number of matter related to the current state and evolution of the lightning protocol (including improvements to scaling, privacy, and usability)

- Jack Dorsey (Block, Inc) released further detail about TBD, a bitcoin-based decentralised exchange

- SethForPrivacy (via Bitcoin Magazine) releases a technical summary of privacy-related improvements that have been proposed or adopted on bitcoin or the Lightning Network

- OXT Research updates their chain analytics visualiser (available for public use) to include better wallet fingerprinting information

Price Analysis – Number Go Up (But Mostly Down)

During the first two weeks of June, bitcoin’s price rapidly decreased from an initial high of AU$44,521 to a monthly low of AU$24,995. In the final two weeks of June, the price gradually increased until closing the month around AU$29,000. Bitcoin's monthly low of AU$24,995 is in line with strong support that was formed at the peak of the 2017 bitcoin bull market. Having said that, bitcoin is also positioned far below strong resistance between AU$40,000 and AU$50,000.

Food For Thought – Bitcoin's Current Crash is Mediocre

If you're relatively new to bitcoin, then the current price action may seem unexpected or uncharacteristic. Having said that, you've likely also heard long-term bitcoiners lamenting or meme'ing about past crashes (e.g., how long they lasted, how much the price dropped, how regular they were, etc).

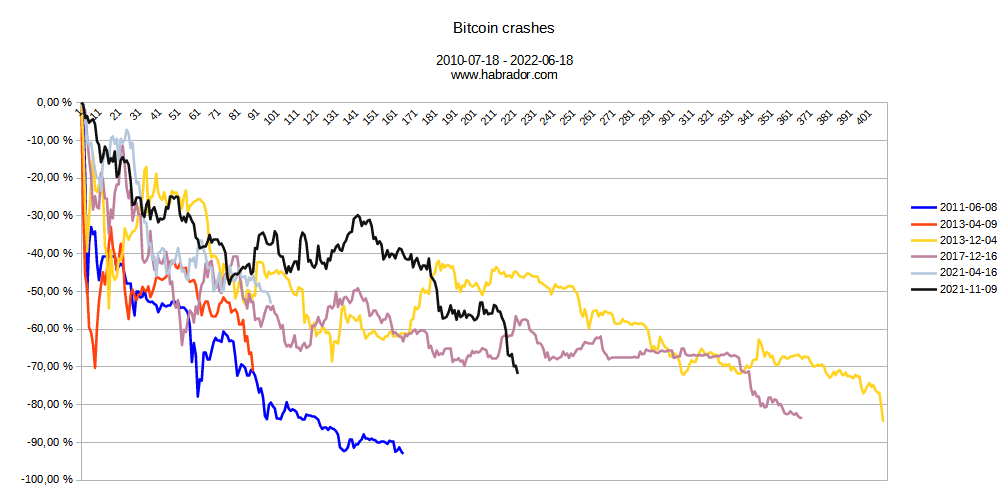

So, what does the data actually say? The chart above visually represents the number of days and percentage of value lost during bitcoin market corrections. Relative to past price reductions, the current one is about on par - that is, the price has not crashed any more significantly or for any longer than it has previously.

This probably seems like a "good news, bad news" situation - the good news being that the current price action is normal based on past performance; the bad news is the price crash may continue lower or for longer than it already has. On the other hand, the ultimate upside is that bitcoin's fundamentals continue to grow stronger regardless of its price - so if you're here for the long-term, then the current bitcoin sale is an opportunity and nothing to be concerned about!

HardBlock Careers - Expression of Interest

Interested in joining the HardBlock team? We occasionally recruit for bitcoiners with a range of skills and experiences. Submit an expression of interest if you're keen!