Self-Managed Superannuation Funds

As bitcoin adoption continues to surge, our clients are increasingly looking for new ways to incorporate it into their portfolio. One way that is gaining popularity is to establish a Self-Managed Superannuation Fund (SMSF) that allows investing in bitcoin.

The process of setting up and operating a SMSF for the purpose of buying bitcoin can seem confusing and expensive at first. However, it is easier and more cost-effective than most realise. To clarify the process, we've prepared this article and this Australian Bitcoin Podcast episode to answer questions like "what is a self-managed super fund?" and "what is required to set up and operate a SMSF for the purpose of investing in bitcoin?"

Bitcoin Headlines

Feeling time-poor and want to listen to the latest bitcoin news? We hear you! Check out the Australian Bitcoin Podcast's recent news episodes for a summary of the stories below (Episode 18 and Episode 20).

Global News

- United Kingdom annual CPI is 9.0% as of April, a 40-year high

- United States annual CPI is 8.3% as of April, remaining close to 40-year highs

- President of El Salvador announces 32 central banks and 12 financial authorities (44 countries) will meet in El Salvador to discuss financial inclusion, digital economy, banking the unbanked, and the El Salvador bitcoin rollout

- Panama passes legislation that encourages bitcoin businesses to set up in Panama and makes bitcoin payments and income tax free

- International Monetary Fund (IMF) expresses concerns over Central African Republic adopting bitcoin as legal tender, similar to the warning they issued to El Salvador for doing the same

- IMF loans Argentina US$45 billion with strict stipulations that Argentina must discourage bitcoin adoption; major private Argentinian banks were set to release bitcoin-related products as the national currency's annual inflation rate surpassed 50%, but Argentina's Central Bank banned this from occurring at the last minute

- World Economic Forum (WEF) releases a "change the code" campaign video consisting of disproven energy FUD aimed at pressuring bitcoin to change from proof-of-work mining; WEF then gets schooled in the comments by bitcoiners who have actually done their research

- Bitcoin Mining Council (including Michael Saylor and Jack Dorsey) send an educational letter to the US Environmental Protection Agency to tackle renewed bitcoin energy FUD

- Warren Buffet-backed NuBank (Latin America's largest digital bank) to convert 1% of its cash reserves into bitcoin and to enable bitcoin trading for their customers

- Goldman Sachs (a leading global financial institution) has offered its first ever lending facility backed by BTC as the Wall Street giant deepens its bitcoin product offerings

- Nomura (Japan's largest investment banking broker) to launch a subsidiary focused on institutional bitcoin and digital asset products

- Texas Pacific Land Corporation (one of the largest landowners in Texas) has partnered with with a digital infrastructure provider and bitcoin miner (Mawson Infrastructure and JAI Energy) to establish a 60 megawatt mining facility in West Texas

Australian News

- Cryptocurrency regulation is among new Australian Prime Minister's primary priorities

- Australia's first three bitcoin and cryptocurrency ETFs delayed at the last minute during April, although at least one 100%-backed spot bitcoin ETF was later released mid-May on the Australian secondary market (CBOE)

- Australian Bitcoin Industry Body confirms which Australian Federal election candidates support bitcoin or cryptocurrency

- Senator Andrew Bragg hosts an Ask Me Anything (AMA) on Reddit regarding his views on upcoming Australian regulation for bitcoin and cryptocurrencies

Technical News

- Confused about BIP-119 (OP_CheckTemplateVerify / Covenants)? You're not alone! See here for comprehensive detail on the original proposal and the responses from developers, miners, and users

- Unsure how BIPs (Bitcoin Improvement Proposals) are implemented? Confused by terms like "Miner Activated Soft Fork (MASF)", "User Activated Soft Fork (UASF)", "User Resisted Soft Fork (URSF)", and "Speedy Trial"? Check out this article

- New bitcoin mining data released by the Cambridge Centre for Alternative Finance confirmed the growing dominance of the US (accounting for 37.84% of bitcoin mining) and revealed a resurgence of China as the second largest mining hub (21.11%); however, an article later released by Bitcoin Magazine indicated this Cambridge report may be unreliable given the significant difficulty in tracking accurate mining data

Price Analysis – Bitcoin Dead For ~448th Time; Luckily It Has 21 Million Lives

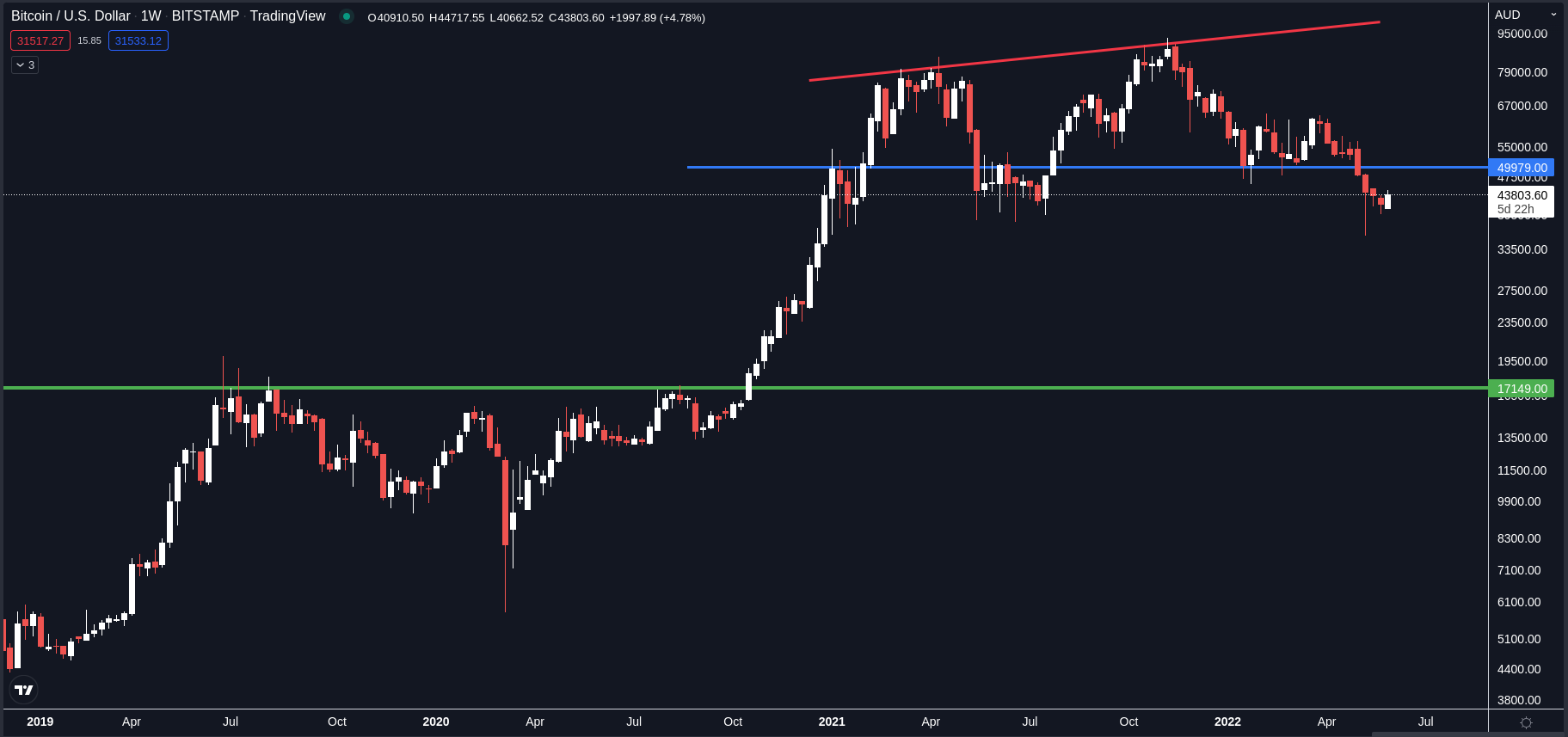

During May, bitcoin’s price declined from an initial high of AU$56,417 to a monthly low of AU$36,582. In the final two weeks of May, the price fluctuated in a range between AU$39,498 and AU$45,808 until closing the month at around AU$43,830. The overall chart pattern now appears bearish, as the lower low set during May has broken the uptrend that was forming from January to April. Bitcoin's price is now positioned underneath strong resistance (previously long-term support) at about AU$50,000.

On a Lighter Note - On 22 May 2010, Bitcoin Pizza Day Was 'Born'

On 22 May 2010, Laszlo Hanyecz paid 10,000 bitcoin for two delivered Papa John's pizzas. In today's value that would be around AU$430,000,000. At the bitcoin all-time-high it would be worth about twice that much! We sure hope they tasted nice!