When fiat money hyperinflates and dies, there will be two options left – gold or bitcoin. With that in mind, gold buyers from Adelaide are realising they can't afford to not invest in bitcoin too.

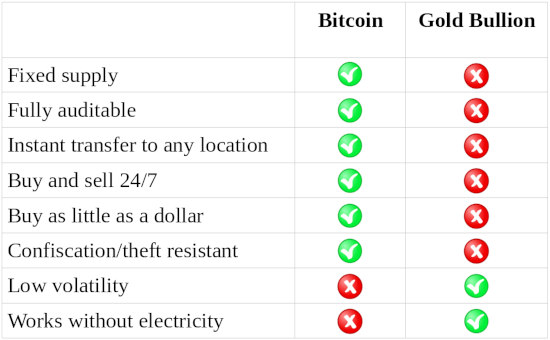

After all, which one seems more likely to be chosen to settle debts and store wealth in a post-fiat world? Bitcoin? The most difficult asset to confiscate, impossible to inflate away, transferred instantly anywhere for nearly-free, and able to be stored in one’s mind. Or gold? A hard asset, but relatively more expensive to securely store and transport.

Many gold buyers in Adelaide are also strongly considering bitcoin due to recent insights from Michael Saylor (CEO of MicroStrategy – the world’s largest publicly-traded business intelligence company). Saylor believes the AU$14 trillion gold market will be transferred to bitcoin as individuals and companies begin storing their generational wealth in the more advanced and scarce digital asset.

Saylor noted that at gold’s 1.5% annual inflation rate, if he bought all (100%) of the gold supply today and held it for 100 years, then at the end of that time he would only hold ~23% of gold’s supply! On the other hand, if he bought a portion of bitcoin’s 21 million supply today, then he would still hold that same portion in 100 years (or even 1000 years!). It would also cost considerably less to move the bitcoin or to secure it from theft or confiscation during that time.

With properties like that, it's no surprise gold investors are also buying bitcoin as an inflation hedge. And for gold buyers in Adelaide, the process has never been easier – HardBlock Bitcoin Exchange is located in Adelaide CBD and can provide personalised help to get started.

If you’re interested to learn more, then sign-up or contact us at hello@hardblock.com.au

HardBlock is an Australian bitcoin exchange established in 2014 – we have a simple sign-up, no deposit or withdraw fees, and friendly client support.