HardBlock Sponsors the Australian Bitcoin Podcast

To achieve our goal of educating Australians about buying and holding bitcoin in a self-sovereign and privacy-conscious way, HardBlock has sponsored the Australian Bitcoin Podcast - there are already three episodes out (available on Anchor.fm, Spotify, Google Podcasts, Apple Podcasts, PocketCasts, CastbBox, and YouTube)! The first three episodes include an introduction to our regular co-hosts, an answer to the seemingly simple question "What is bitcoin?", and a digest of recent global and Australian bitcoin news. Have a listen and share it around. Let us know your feedback or any suggested content!

Bitcoin Adoption Continues to Surge

If you thought 2021 was big for adoption news, then we think 2022 might blow your mind. Within the month of February we've already seen considerable adoption news from America, Russia, Ukraine, Thailand, and large corporate institutions. To avoid this section becoming a full newsletter of its own, we'll just list the highlights:

- Texas Governor (Greg Abbott), Texas Governor Candidate (Don Huffines), and Texas Senator (Ted Cruz) asserted they will make Texas the bitcoin hub of America.

- Arizona Senator (Wendy Rogers) proposed a bill which would make bitcoin legal tender in Arizona.

- Tennessee State Representative (Jason Powell) introduced a law to allow the Tennessee state government to invest in bitcoin.

- New Hampshire Governor (Chris Sununu) signed an Executive Order aimed at attracting more bitcoin businesses to the state.

- State of California proposed a law to make bitcoin legal tender.

- State of Idaho introduced a bill to define bitcoin and digital assets as personal property.

- State of Colorado passed a law to allow bitcoin to be accepted for tax payments. Utah also proposed a law to enable the same thing.

- State of Georgia and Illinois proposed laws to give tax breaks to bitcoin miners, as a way to attract more miners to their states.

- Russian Ministry of Finance and the Russian Central Bank agreed to regulate bitcoin and other cryptocurrencies, as a way to utilise their strategic advantage in industries such as bitcoin mining and to protect their citizens which they believe hold as much as 12% of the total supply of cryptocurrencies.

- Ukraine legalised bitcoin and cryptocurrencies to allow its citizens greater access to buying, holding, and selling digital assets.

- Thailand proposed new laws to more clearly regulate bitcoin and other digital assets, including removing an originally-proposed 15% tax on cryptocurrency income.

- KPMG Canada announced they will add bitcoin to their corporate treasury.

- Tesla's recent earnings report indicated they have retained their previously-purchased bitcoin in their corporate treasury.

Price Analysis – Choppy With a Chance of Saving in Hard Money

During January, bitcoin’s price declined from a high of around AU$66,000 to a low of about AU$45,000. Since then, price recovered during early February to a high of AU$64,750, then fell back down to set a "higher low" at AU$47,900 towards the middle of February, before finally recovering to AU$54,900 by the end of the month.

Many traders call this price action "choppy", as the value primarily moves sideways with alternating rises and falls without a clear trend in either direction. While this makes difficult work for traders and investors with a short-term outlook, it's a perfect setup for long-term holders to continue dollar-cost-averaging more bitcoin!

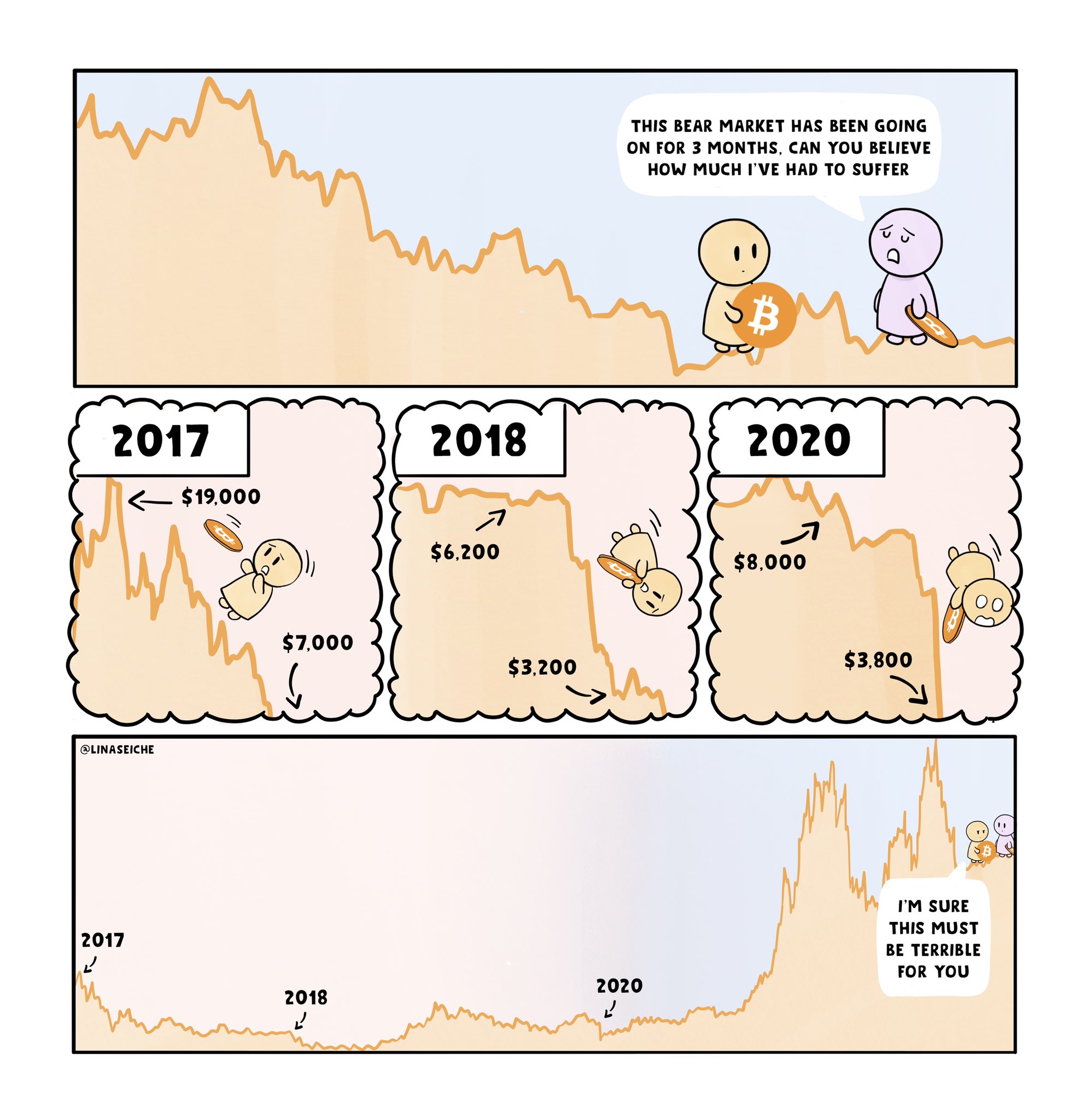

On a Lighter Note - Long-term Bitcoin Holders Are Zen, Even During Bear Markets!

If you're a new bitcoin holder concerned by recent price action, then look to a longer-term bitcoiner to see what they're doing. You'll likely find they are patiently dollar-cost-averaging, diligently watching news about bitcoin fundamentals, and calmly riding the price waves.

Price dips are inevitable, as are "bear markets" (in which the price trends or stays down for a longer period of time). Embracing this short-term value volatility is an important part of holding bitcoin; if it seems difficult now, then rest assured it gets easier with practice!

Self-sovereign Corner – Reduce the Risk of an Exchange Account Hack

There was a recent Australian news story about a user who had around $100,000 AUD worth of cryptocurrency stolen from their exchange account (to clarify: this did not happen on HardBlock!). The user bought cryptocurrency on the exchange and left it there for several months thinking it was safe. When he later logged back in to withdraw his funds, he discovered a hacker had stolen everything. Unfortunately, because account security is primarily the responsibility of the user, the exchange did not reimburse the stolen funds.

How did this happen? It looks unlikely that this was a targeted hack; instead, the hacker was able to gain access to the account because the user had re-used their email and password on other websites and one of those websites suffered a data leak that affected over one million accounts. The hacker, who got access to this very large list of leaked credentials, used each email and password combination to attempt to log in to various exchanges until one of them worked.

How could the risk of a hack like this be reduced? Here are our suggestions:

1. Do not keep bitcoin on an exchange or any third-party platform! Withdraw your bitcoin to a wallet which you control the keys to (preferably a cold storage hardware wallet). When in doubt, remember the phrase "not your keys, not your coins."

2. Always use a strong and unique password on both your email and exchange accounts. You can use Bitwarden or another password manager to make it easier to choose and remember strong and unique passwords. See our January Newsletter for more information about using a password manager.

3. Set up two-factor authentication (2FA) on both your email and exchange accounts. See our 2FA help article to understand what it is and how to set it up on your HardBlock account.

4. Use a separate email address for your exchange account rather than the usual email which you use for everything else. Bonus points if you choose a privacy-conscious email service - see our November Newsletter for more information on setting up private email.

5. Turn on email alerts (if possible) for important exchange activity, such as logins from new devices or IP addresses, withdrawal requests, and changes to account settings.

If you would rather listen to a discussion about this news story and the strategies to reduce exchange account hack risk, then check out this clip from the Australian Bitcoin Podcast:

Please note we are not paid to advertise any of the above services (e.g., Bitwarden, 2FA solutions, or private email providers) – these are just suggestions based on our research.