Will 2022 Be Bitcoin’s Biggest Year?

2021 was arguably Bitcoin’s biggest year yet. Numerous individuals, institutions, and even a nation-state adopted bitcoin. The network participants, transaction volume, and price set new all-time-highs. And we began to see the potential of second-layer and side-chain solutions (e.g., Lightning Network, Liquid Network, and Synonym).

So, what does Bitcoin have in store for 2022? Here are some of our predictions:

- More politicians, professional athletes, and celebrities will take their salary in bitcoin.

- More institutions will keep bitcoin as a reserve asset.

- More businesses, including banks, will accept bitcoin payments and/or offer bitcoin products/services.

- Another nation state will move significantly towards adopting bitcoin as a currency.

- Bitcoin network participation will continue to grow (e.g., Lightning Nodes will hit another all-time-high, as will the transaction volume on the Bitcoin network overall).

- Utility of second-layer and side-chain solutions will reach new milestones (e.g., we’ll see tokens, like USD Tether or even NFTs, on the Bitcoin network).

- Bitcoin will continue to become more secure and decentralised (e.g., hash rate will set another all-time-high, and we’ll see new institutions producing and utilising bitcoin mining hardware).

- A bitcoin-focused ETF will be released on the Australian Stock Exchange (ASX).

- Additional Bitcoin-related companies will list on the ASX.

Let us know your predictions. We’ll check back at the end of 2022 and see how we did!

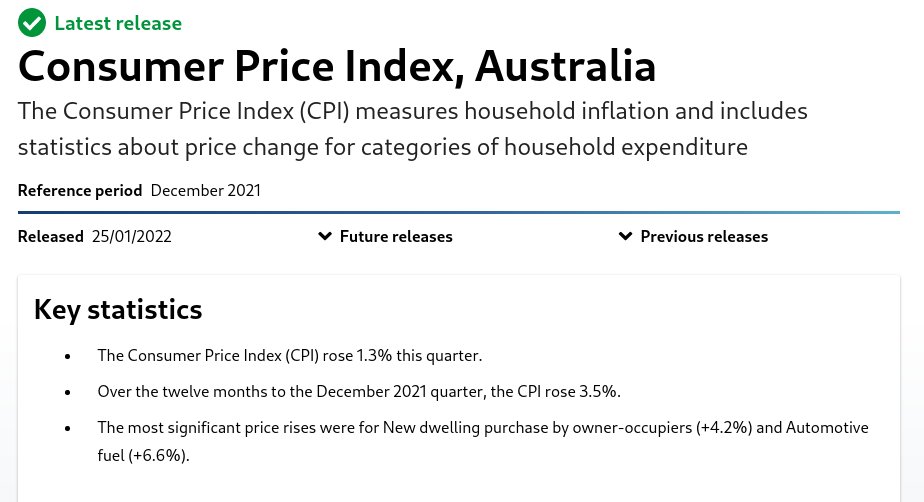

Australia Consumer Price Index Update

On 25 January 2022, the Australian Bureau of Statistics released the updated annual Consumer Price Index (CPI): 3.5%! This is an increase from the previous annual CPI of 3.0% (i.e., from the September 2021 figures).

One way of looking at this figure is that for every 10 years you save in fiat currency, you are losing around 41% of the value of your savings. Having said that, we expect real inflation to be much higher than this, considering the CPI is an underestimate based on an adjustable basket of goods.

For more information on how to properly gauge price inflation (or monetary value debasement), then see our recent article titled Getting Ahead of Inflation.

Bitcoin Developers Legal Defence Fund

On 12 January 2022, Jack Dorsey (CEO of Block and ex-CEO of Twitter) announced that he, Alex Morcos (Co-Founder of Chaincode Labs), and Martin White (Professor of Computer Science at the University of Sussex) have established a non-profit legal fund which aims to minimise vexatious legal proceedings that discourage software developers from actively working on Bitcoin and its related projects (including the Lightning Network). The Fund intends to find and retain defence lawyers, develop litigation strategies, and pay legal bills. The Fund is available to be used as a free and voluntary option for Bitcoin developers.

This is big news, because legal attacks aimed at software developers have remained an unmitigated attack vector for Bitcoin. For example, three long-term Bitcoin developers recently stepped down from the project due to “legal risks” (i.e., Jonas Schnelli, Samuel Dobson, and John Newbery). Relatedly, there is the ongoing Tulip Trading lawsuit, in which Craig Wright claims to be the victim of private key theft connected to around $5.7 billion (USD) worth of Bitcoin. In this lawsuit, Craig Wright is suing numerous software developers, including many prolific bitcoiners (e.g., Jonas Schnelli, Matthew Corallo, Peter Todd, Marco Falke, Wladimir Van Der Laan, and Pieter Wuille). The Bitcoin Legal Defence Fund’s first action will be to take over and coordinate the defence against Craig Wright.

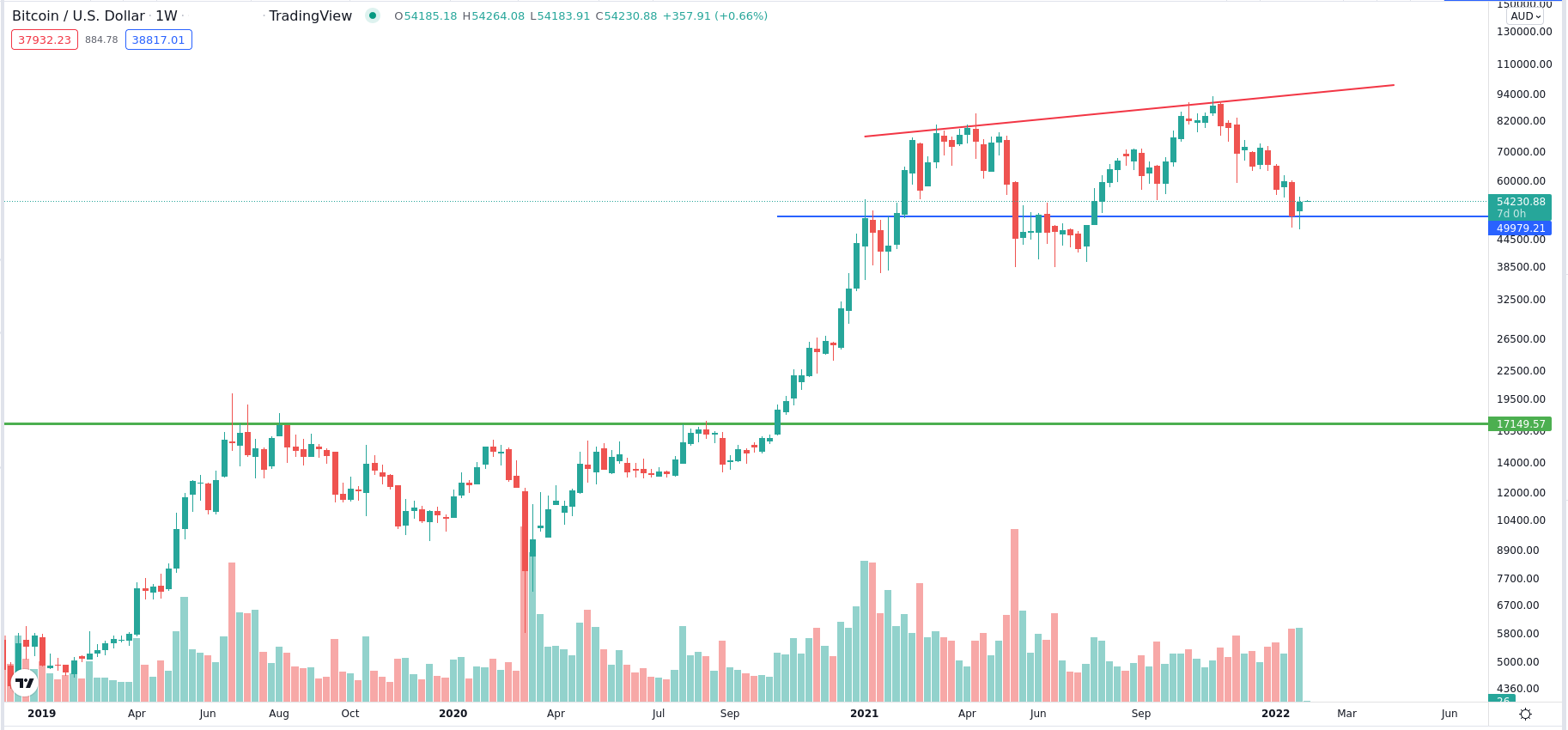

Price Analysis – Don’t Stress, Keep Dollar Cost Averaging!

Following bitcoin’s price setting a new all-time-high during November 2021 (i.e., AU$93,000 and US$69,000), the value has gradually declined through through December and January to find strong support at a low of $AU45,750 (or $US33,000).

It’s worth noting that on-chain analysts (e.g., Dylan LeClair, William Clemente, and Willy Woo) have indicated that bitcoin’s recent price drops have resulted primarily from over-leveraged traders being liquidated, rather than a change in fundamental market sentiment. Despite significant price reductions being temporarily painful, this “clearing out” of over-leveraged trade positions has several benefits, such as reducing the possibility of much larger liquidation events in the long-term and giving long-term holders access to cheap bitcoin (which in turn establishes a more stable HODLer-supported price floor).

In sum, if you’re dollar cost averaging, then these values are an opportunity to accrue cheaper bitcoin, rather than a reason to be stressed!

On A Lighter Note - Dollar Cost Average The Dips!

If you like eggs and eggs go on sale, then you buy the same amount as usual or maybe more. You don’t wait for eggs to go back up in price!

This same concept applies to bitcoin. If the price is down, but the fundamentals remain the same (or better yet, they’ve improved), then your bitcoin accrual strategy shouldn’t change! This is a key benefit of DCA’ing, no matter the price.

Self-sovereign Corner – Upgrade Your Password Management

HardBlock aims to help users become privacy-conscious self-sovereign bitcoiners. One way we do this is with actionable tips each newsletter to improve your privacy and security. In the November Newsletter we provided simple steps to upgrade your email privacy. This month, we’re focusing on password management.

Why should you use a dedicated password manager to generate and store your passwords? To put it simply: humans are a terrible source of entropy (i.e., randomness) and our memory is fallible! This means we often re-use passwords (or even parts of passwords), which makes us vulnerable if an attacker were to discover this information. Seeing as passwords are frequently leaked in data breaches, this risk cannot be understated! For example, check out Have I Been Pwned to see if any of your old passwords have been leaked.

The other issue is that we often forget passwords, which can be inconvenient and time-consuming to reset them. Plus, each time we reset forgotten credentials, we’re more likely to choose one of our less secure commonly-repeated passwords!

When using a dedicated password manager, you can generate unique and strong passwords for every website you use, and you remove the chance of later forgetting the password. If you took our advice in the November Newsletter and are now using private email aliases to log in to websites, then using a password manager will simplify that process significantly too.

While there are numerous password management options, we tend to prefer Bitwarden. This is because Bitwarden is: open source (so their code and claims are verifiable); end-to-end encrypted (so your sensitive data is protected, even from Bitwarden); available on most browsers and devices; available in both online and offline options (including a self-hosting option for advanced users); and free to use.

Remember to not let “perfect” be the enemy of “good” when it comes to your privacy and security. Changing to a password manager may seem long-winded, but if you make it a gradual process (e.g., adding just one login credential per day to your password manager), then it can be relatively painless and you’ll quickly start benefiting from the added convenience and security!

Please note that we are not paid to advertise any of the above products or services – they are just our suggestions based on our own research.